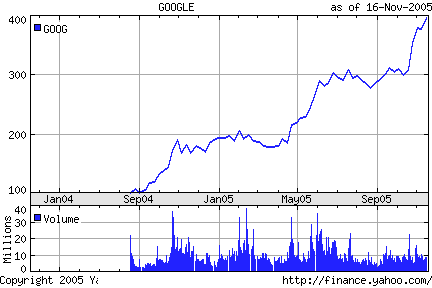

I don’t know anything about financial markets, but if I’m reading this graph correctly, if I’d put the entire car account into google stock (or shares or whatever it’s called) this time last year, I’d have more than enough money for the car now. And left over change for so many other goodies.

It can’t possibly be that simple.

What if it had gone down?

Unfortunately or fortunately, depending how you look at it, everything is quite simple.

K.: But with some information on the company, their business model and “evilness rating” and some common sense, how hard could it be to separate the wheat from the chaff?

Adi: Yeah, I was just made to believe it was very complicated—you know from all the relatives who make a living this way and friends who’ve recently branched out into financial management and other such commercial avenues.

after seeing how much money all my relatives here lost by investing in tech stocks in the late 90’s, i’m hesitant to do so. the main thing is knowing when to sell. people tend to get greedy, think it’ll keep going up some more…then all of sudden, it might crash.

that said, google was probably a safe bet.

I wasn’t referring to tech stocks or google in particular, just toying with the notion that this couldn’t be so hard if one were informed enough.